Investors

Silver 101

Why Silver?

Silver is a precious metal that has been valued for thousands of years due to its various industrial, investment, and ornamental uses. It has a rich history of being used as currency, jewelry, and as a component in numerous industrial applications.

How and Where Is Silver Extracted?

Silver ore is mined through both open-pit and underground methods. The open pit method involves using heavy machinery to mine deposits relatively near the Earth’s surface. In underground mining, tunnelling deep shafts into the ground allows for the extraction of the ore. With extraction completed, the ores are crushed, ground, and then separated through a process called “flotation” to achieve mineral concentrations 30-40 times higher than natural occurrences. Refiners then further concentrate this extraction through the process of electrolysis or amalgamation.

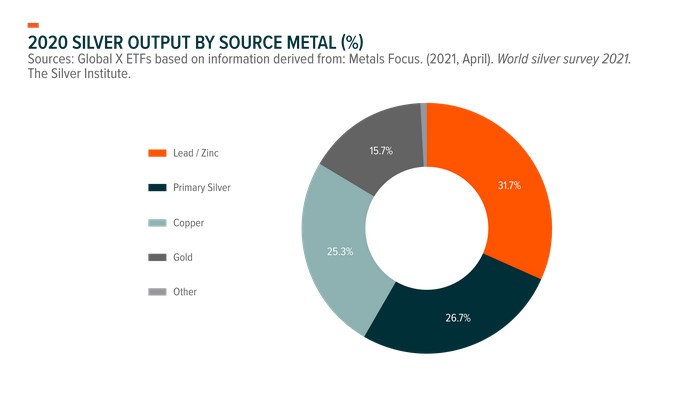

Only 27% of silver derives from mining activities where silver comprises the primary source of revenue. The remaining 73% comes from projects where silver is a by-product of mining other metals, such as copper, lead, and zinc.2 As expected, the revenues of firms focused on primary silver production tend to be much more impacted by silver prices than firms that produce it as a by-product.

Where is Silver found?

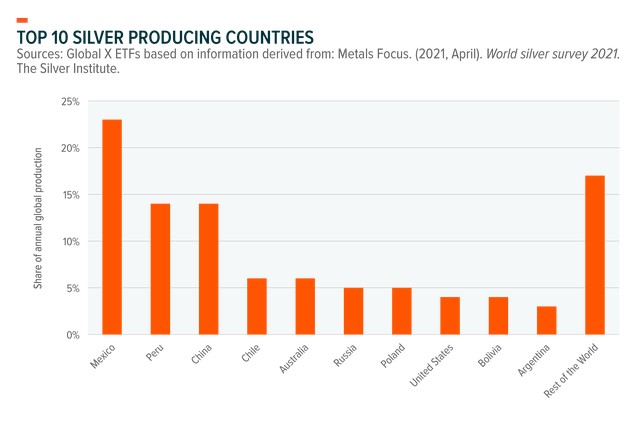

Silver can be found across many geographies, but approximately 56% of the world’s silver production is found in the Americas, with Mexico, Peru, and Chile supplying 43%.3 Outside of the Americas, China, Australia, and Russia combine to make up nearly 25% of the world’s production.

Where is Silver going?

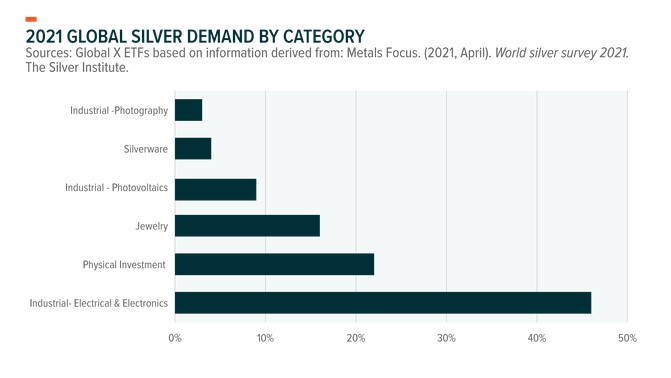

Industrial Demand: Silver is highly sought after in various industrial sectors due to its unique properties. It is an excellent conductor of heat and electricity, making it crucial in electrical contacts, switches, and conductors for electronics, solar panels, and batteries. It is also used in the production of photographic films and X-rays, as well as in the automotive industry for various applications. Additionally, silver's antimicrobial properties make it valuable in medical instruments, wound dressings, and water purification systems.

Investment Demand: Silver is considered a safe-haven asset and is often used as a store of value and a hedge against inflation. Investors view silver as a tangible asset that can preserve wealth during economic uncertainty. It is traded on various commodity exchanges worldwide, and investors can purchase physical silver in the form of coins, bars, or rounds. Silver's relatively lower price compared to gold also makes it accessible to a wider range of investors.

Jewelry and Silverware: Silver has a long history of being used in jewelry and decorative items. Its lustrous appearance and malleability make it a popular choice for creating intricate designs and adornments. In addition to jewelry, silver is also used to make silverware, tableware, and decorative objects.

Material and statistics in this section were adapted in part from the Silver Institute’s World Silver Survey 2023. https://www.silverinstitute.org/silver-supply-demand/

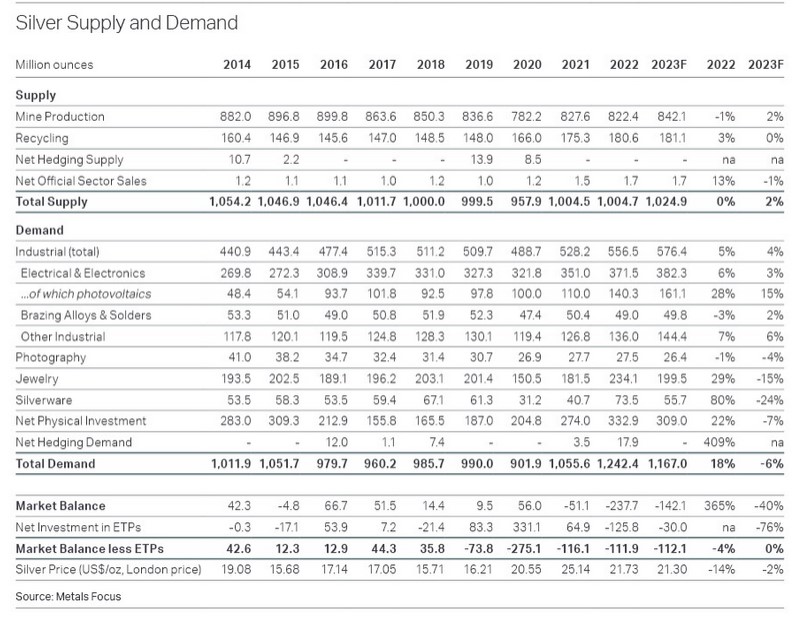

Supply and Demand Dynamics: The demand for silver is influenced by various factors, including industrial and technological advancements, jewelry and silverware demand, investment trends, and global economic conditions. Fluctuations in these factors can impact the overall demand for silver.

In recent years, the growing demand for renewable energy technologies, such as solar panels, has contributed to increased silver demand due to its use in photovoltaic cells. The rising popularity of electric vehicles and the need for silver in their production has also fueled demand. Additionally, increasing industrialization and urbanization in developing countries may further boost silver demand.

THE RATIO (Gold to Silver Ratio)

Silver and gold are often compared due to their classification as precious metals. However, there are two significant differences between them: the industrial usage of silver and their relative market sizes.

In terms of industrial usage, silver has a higher reliance on industrial demand compared to gold. Around 58% of silver's annual demand comes from industrial applications, such as electronics and photovoltaic industries. In contrast, only about 8% of gold's demand is driven by industrial use, with the majority attributed to jewelry and gold bars. This distinction means that gold is predominantly considered a precious metal, while silver's price is influenced by both the demand for precious metals and industrial demand.

Regarding market size, the gold market is vast and surpasses the value of the European sovereign debt market. On the other hand, the silver market is considerably smaller and tends to be more volatile. In London's wholesale dealing, the silver market is one-tenth the size of the gold market, and in terms of COMEX futures, it is one-fifth the size of the gold market.

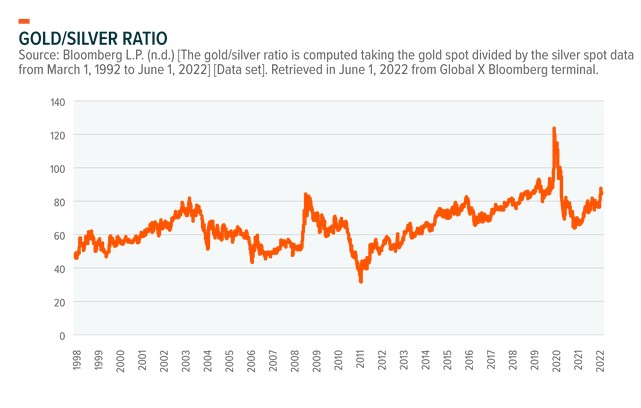

One commonly cited figure is the gold-to-silver ratio, which represents the amount of silver required to purchase one ounce of gold. This ratio helps track the relative prices of these metals and can indicate when one metal is potentially cheaper or more expensive than usual. Over the past 30 years, the average gold-to-silver ratio has been around 65. Currently, the ratio is approximately 78, suggesting that silver may be undervalued compared to gold.

2026 AGM Materials Available in H1 2026

TSX-V: IPT

Last:Change:

Volume:

OTCQB: ISVLF

Last:Change:

Volume:

FRA: IKL

Last:Change:

Volume:

The FSE stock information above is EOD and may not reflect current data.

IMPACT Silver

Jerry Huang, VP Finance & Investor Relations

Suite 303543 Granville Street

Vancouver, BC

Canada V6C 1X8

Email: inquiries(at)impactsilver(dot)com

Tel: 604 664-7707

Toll-Free: Direct # 778-867 -7909 (Courier)