Operations

Production Centres

-

- IMPACT Silver has production centres in central Mexico (Zacualpan) and northern Mexico (Chihuahua).

- On its 211-square-kilometer land package in the Zacualpan area, IMPACT operates the Guadalupe Production Centre in the north, and has the Capire Production Centre (currently on care and maintenance) in the south.

- In Chihuahua, IMPACT is restarting the recently acquired Plomosas Production Centre.

Guadalupe Production Centre

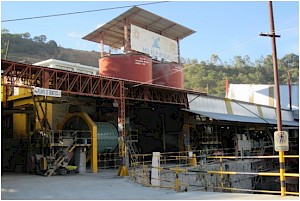

The Guadalupe Production Centre is a 535-tonne-per-day ("tpd") crushing and flotation plant located in the Royal Mines of Zacualpan Silver-Gold District of central Mexico. It is currently the Company's primary operating processing facility. Since acquiring the project in 2006, IMPACT has carried out an extensive program of upgrading operations and expanding production; the Company has upgraded the majority of the mining equipment, including the expansion of the tailings dam (continuing).

The Guadalupe Production Centre is currently fed by four underground mines at Guadalupe, San Ramon, Alacran, and Cuchara as well as the Veta Negra Open Pit Mine.

Plomosas High Grade Zinc-Silver Production Mine (Chihuahua)

The recently acquired Plomosas project is undergoing a major refurbishing and upgrading of the mill and underground mine with plans to restart operations later this year. It is a high-grade zinc-lead-silver producer located 110 kilometres by road from Chihuahua City, the state capital.

The 3,019 hectare property covers extensive carbonate replacement deposit-type ("CRD") zinc-lead-silver mantos (beds) mainly hosted in carbonates (limestones, marbles). The previous operator reported Australian JORC mineral resources of 215,000 tonnes grading 13.5% zinc, 6.3% lead and 34.0 g/t silver indicated, and 772,000 tonnes grading 13.1% zinc, 3.0% lead and 19.0 g/t silver inferred, at a 3% zinc cutoff at December 2021 (see Footnote 1 (Cautionary Statements) and IMPACT news release dated April 3, 2023 for details). IMPACT is currently carrying out a drill program to infill and test extensions of the known mineralization.

The project has exceptional exploration upside potential with only 600m of the 6 kilometre-long carbonate replacement structure having been explored to date. This is in addition to other exploration targets on the property including untested copper-gold targets with high-grade surface prospecting samples. Regionally, Plomosas lies in the same mineral belt as some of the largest carbonate replacement deposits in the world.Capire Production Centre

IMPACT's second production centre in the Zacualpan area is Capire which is currently on care and maintenance waiting for higher silver prices before re-commencing production. Capire is located 16 kilometers southwest of the Guadalupe Production Centre, in the Capire-Mamatla Mineral District and consists of an open pit mine and a 200 tpd processing plant with infrastructure to expand. It is a silver-rich volcanogenic disseminated and massive sulphide ("VMS") deposit with zinc and lead credits.

IMPACT's second production centre in the Zacualpan area is Capire which is currently on care and maintenance waiting for higher silver prices before re-commencing production. Capire is located 16 kilometers southwest of the Guadalupe Production Centre, in the Capire-Mamatla Mineral District and consists of an open pit mine and a 200 tpd processing plant with infrastructure to expand. It is a silver-rich volcanogenic disseminated and massive sulphide ("VMS") deposit with zinc and lead credits. Capire Mineral Resource

On January 18, 2016, IMPACT announced NI43-101 mineral resources for the Capire Zone as follows and then filed a supporting technical report on www.sedar.com on March 3, 2016.

Total Resource at US Dollar per Tonne Cutoffs - Inferred and Unoxidized Cutoff Inferred Mineral Resources US$/t Tonnes US$/t g Ag/t %Zn %Pb Oz Ag lbs Zn lbs Pb 10 4,465,000 36.20 44.21 0.72 0.31 6,346,000 71,183,000 30,212,000 15 3,450,000 43.24 53.03 0.85 0.37 5,881,000 64,914,000 28,072,000 20 2,707,000 50.37 62.22 0.98 0.43 5,414,000 58,444,000 25,755,000 25 2,177,000 57.19 71.06 1.10 0.49 4,974,000 52,766,000 23,522,000 30 1,786,000 63.74 79.49 1.22 0.54 4,563,000 47,975,000 21,423,000 35 1,490,000 69.96 87.65 1.33 0.59 4,199,000 43,692,000 19,504,000 40 1,242,000 76.47 96.20 1.45 0.65 3,842,000 39,596,000 17,666,000 45 1,035,000 83.30 105.37 1.56 0.70 3,507,000 35,693,000 15,905,000 50 859,000 90.69 115.49 1.69 0.75 3,189,000 31,983,000 14,203,000 60 636,000 103.31 133.60 1.88 0.84 2,732,000 26,339,000 11,793,000 70 489,000 114.89 150.72 2.04 0.92 2,370,000 22,034,000 9,909,000 80 381,000 126.33 167.97 2.20 0.99 2,057,000 18,455,000 8,338,000 90 294,000 138.53 187.15 2.34 1.07 1,772,000 15,194,000 6,966,000 The reported resource (“Base Case”) cutoff grade is US$30/tonne in the table. The mineral resources in this disclosure were estimated by Mine Development Associates (“MDA”) of Reno, Nevada. The resources were estimated using Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) standards, definitions and guidelines. The resources were estimated by inverse distance cubed (“ID3”) and checked the estimate with inverse distance to the 4th power, kriging, and nearest neighbour.

The table presents the inferred diluted resources at Capire using total-metal (silver, zinc and lead) dollar-value cutoffs. The model block size is 3 metres by 3 metres by 3 metres. The diluted resources are displayed at multiple cutoffs, but the resource is reported at a cutoff of US$30/t lying within a pit optimized using $31/oz silver, $1.51/lb zinc, and $1.69/lb lead. MDA considered a US$30/t cutoff to be appropriate at the time for production using IMPACT’s 200 t/d mill and recoveries around 80%, 50%, and 65% for silver, zinc and lead, respectively. The resources were generated within an optimized pit shell on the Capire zone that best conveyed “reasonable prospects for eventual economic extraction” at the time which is a requirement of the 2014 CIM Definition Standards, incorporated into Canadian National Instrument 43‑101. There is additional mineralization too deep to fulfill the criteria of “reasonable prospects for eventual economic extraction” within an open pit, but that may be available for potential underground development. For further details on the Capire mineral resource see IMPACT’s news release dated January 18, 2016.

Quality Assurance/Quality Control ("QA/QC") protocols were carried out to assess the quality of the drilling assay results and the confidence that can be placed in the assay data. The QA/QC data available at Capire demonstrate the analytical data are sufficient to be used in estimating Inferred resources. The drill spacing is tighter in the central area. Overall the average distance to the nearest composite sample is 20m (less in the central area), and the average distance to all composites used in the estimation is 40m (less in the central area).

Three separate drill-hole database and composite files were built, one for each of silver, zinc and lead. Each drill-hole database was composited to three-meter lengths respecting each metal's domain and the alluvium contacts. Samples from the open pit mining blast-holes and samples logged as alluvium were excluded from compositing. There was no minimum width for compositing because the composites are length-weighted during grade estimation. This new mineral resource is based on improved geological and structural modeling over the previous 2011 mineral resource. MDA used this new geologic interpretation as the foundation for building mineral domains for silver, zinc and lead. Those domains followed the sedimentary/ volcanic package contacts and respected the structural deformation defined within the sedimentary package.

The interpretations were made as polygons digitized on the same 20m-spaced sections. The polygons were extruded halfway to adjacent sections to obtain a volume for model coding and controlling the estimate. The extrusion of these polygons, rather than snapped-in-3D polygons and constructing solids or solid equivalents, was done at the request of IMPACT to reduce work and reduce the time to completion. That was a principal reason for the Inferred classification, which could otherwise have been higher with minor additional work. Statistics by each domain for each metal and by domain were evaluated and in part used to determine capping levels. Capping levels were determined for each metal in each domain, using quantile plots and considering coefficients of variation.

The differences between the previous 2011 publically reported tonnes and grade at Capire and those reported as the current resources here are substantial. The Base Case resources reported in this new estimate are much smaller than those previously reported, in part because the current resources were estimated with tighter constraints, both geostatistical and geological, and in part because they lie within an optimized pit shell and exclude additional mineralization lying at deeper levels. Much of this deeper mineralization was included in the 2011 estimate. That deep mineralization may be available for potential underground development but that remains to be studied and is not included in the current resource tabulation.