IMPACT Silver Corp. ("IMPACT" or the "Company") is pleased to announce it has signed a Share Purchase and Sale Agreement (the "Sale Agreement") with Consolidated Zinc Limited (CZL:ASX) ("CZL") of Australia dated February 9, 2023 to purchase all of the outstanding shares of its subsidiary, Minera Latin America Zinc S.A.P.I de C.V.("MLAZ"), which holds a 100% interest in the Plomosas zinc-lead-silver mine in the state of Chihuahua, northern Mexico.

HIGHLIGHTS

- The acquisition will expand IMPACT's production profile from one to two producing operations – the Plomosas zinc-lead-silver district in northern Mexico and the Royal Mines of Zacualpan silver-lead-zinc(-gold) district in central Mexico.

- The purchase price is US$6 million consisting of a minimum US$3 million cash and the balance in IMPACT shares plus a 12% net profit interest royalty to CZL. Completion of the transaction is anticipated on or before April 7, 2023.

- CZL reported Plomosas JORC mineral resources1 of 215,000 tonnes grading 13.5% zinc, 6.3% lead and 34.0 g/t silver indicated, and 772,000 tonnes grading 13.1% zinc, 3.0% lead and 19.0 g/t silver inferred, at a 3% zinc cutoff at December 2021. IMPACT plans a drill program in 2023 to infill and test extensions of the known mineralization.

- Plomosas is host to high grade mineralization. Historical mining is in the global upper quartile for zinc grade with approximately 2.5MT mined since 1943 grading 15-25% zinc, 2-7% lead and 40-60 g/t silver with low deleterious elements2.

- CZL has been mining Plomosas since September 2018 except for some temporary short suspensions during Christmas. IMPACT plans to upgrade the mill and mine with the aim to continue mining followed by plans for expanding operations.

- IMPACT's highly skilled operations team has 17 years of underground mining and flotation milling experience at Zacualpan which it will bring to advance the Plomosas operations.

- Exploration potential at Plomosas is exceptional with only 600m of the 6 kilometre long structure assessed plus other exploration targets on the 3,019 hectare property including untested copper-gold targets. Regionally, Plomosas lies in the same mineral belt as some of the largest silver-lead-zinc carbonate replacement deposits ("CRD") in the world2.

CEO STATEMENT

Chairman and CEO Frederick Davidson commented, "We are truly pleased to acquire a second mining district after evaluating hundreds of projects over the years in an effort to grow IMPACT. Currently Plomosas is a relatively small mining operation on a large mineral system. Our goal is to upgrade and expand operations to optimize production from the large mineral system. Our Mexican technical team is exceptionally skilled in building and efficiently operating mines like this and we will bring our 17 years of underground operating experience at the Royal Mines of Zacualpan to hone and grow the Plomosas operations. The technical and management overlap with similarity of asset and operations provides great synergy for the transaction and represents near term growth of our production levels and value to shareholders."

PLOMOSAS PROJECT OVERVIEW

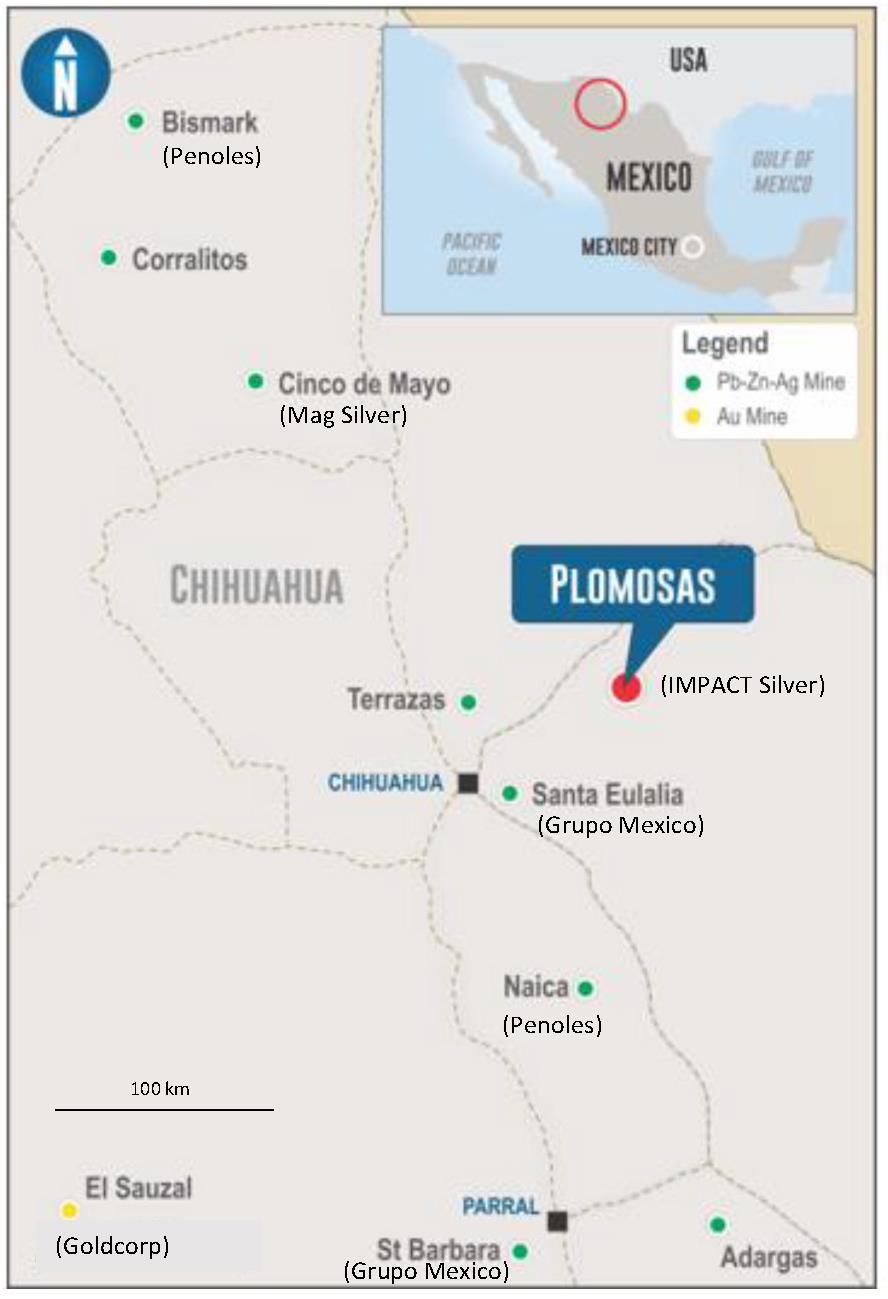

The Plomosas project is located 110 km by road from Chihuahua City, the state capital, which is a two-hour flight from Dallas, Texas, USA. The district was discovered in 1832 and has seen small scale mining since 1868. Historical mining is in the global upper quartile for zinc grade with approximately 2.5MT mined since 1943 grading 15-25% zinc, 2-7% lead and 40-60 g/t silver with low deleterious elements2.

The mine and mill are fully permitted, have an offtake smelter contract2 and have been in production by CZL since September 2018 except for some temporary short suspensions during Christmas. In 2021 CZL processed 31,695 tonnes producing 2,442 tonnes of zinc concentrate and 599 tonnes of lead concentrate. Mine access is by 3 portals reaching a depth of 250m below surface and an old shaft that can be refurbished2. Mineral is processed in a 200 tonne per day conventional flotation mill (recently operating under capacity) with plans to expand. IMPACT plans to upgrade the mill and mine with the aim to continue mining in the near term followed by plans for expanding operations. The Plomosas Property is subject to an underlying 1% Net Smelter Royalty.

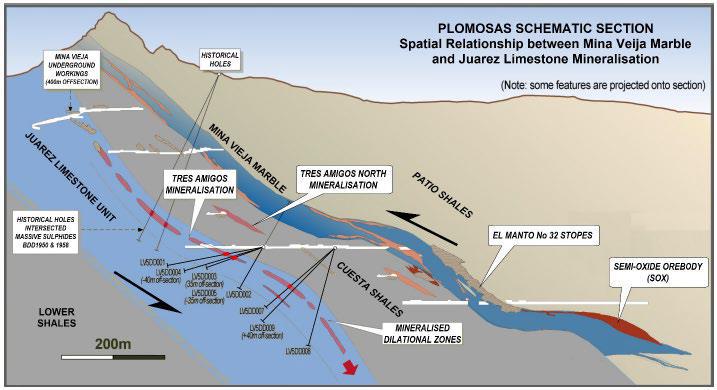

The 3,019 hectare property covers extensive carbonate replacement deposit-type ("CRD") zinc-lead-silver mantos (beds) mainly hosted in carbonates (limestones, marbles). CZL reported Australian JORC mineral resources1 of 215,000 tonnes grading 13.5% zinc, 6.3% lead and 34.0 g/t silver indicated, and 772,000 tonnes grading 13.1% zinc, 3.0% lead and 19.0 g/t silver inferred, at a 3% zinc cutoff at December 2021. IMPACT plans a drill program in 2023 to infill and test extensions of the known mineralization.

Exploration potential at Plomosas is exceptional with only 600m of the 6 kilometre long structure assessed plus other exploration targets including untested copper-gold targets. Regionally Plomosas lies in the same mineral belt as some of the largest CRD deposits in the world (see Map 1)2. The historic Santa Eulalia Mine is the world's largest historic CRD deposit and is located 100km west of Plomosas (see Map 1). Historic production at Santa Eulalia was over 450Moz silver from 51MT averaging 350 g/t silver, 8.2% lead and 7.8% zinc and mined over 300 years. Reference to this nearby project is for information purposes only and there are no assurances that Plomosas will achieve similar results.

TERMS OF THE TRANSACTION

The material terms of the transaction are as follows.

IMPACT will pay the following consideration to CZL for a 100% interest in MLAZ, the Mexican subsidiary of CZL that owns a 100% interest in the Plomosas Project:

- US$6 million consisting of a minimum US$3 million cash and the balance in IMPACT common shares (the "IMPACT Shares"). Closing adjustments based on working capital at closing are provided in the Sale Agreement;

- Contractual restrictions on transfer will be applied to 75% of the IMPACT Shares, such that IMPACT Shares will be released from restriction in three equal tranches of 25% every 6 months over 18 months from closing. 25% of the IMPACT Shares will be immediately held by CZL (subject to a statutory 4 month hold period from the date of issuance of the IMPACT Shares); and

- a 12% net profit interest ("NPI") royalty on production from the Plomosas project to CZL.

It is anticipated that upon closing and assuming US$3 million payment made in IMPACT Shares, CZL will hold approximately 6% of the issued capital in IMPACT. The deemed per share price will be determined in accordance with the Sale Agreement and will be the 20 day VWAP before the date of the Sale Agreement or an equivalent price to an IMPACT financing, should one be conducted before closing.

Completion of the Sale Agreement is subject to certain industry standard closing conditions for a transaction of this kind (the "Conditions") being satisfied or waived by March 31, 2023. Completion is expected to occur within 7 days of the Conditions being satisfied or waived. Conditions include, among others, TSX Venture Exchange approval of the purchase of MLAZ and the issuance of IMPACT Shares as partial consideration.

IMPACT has cash on hand to close the Sale Agreement, but may conduct a financing in the near-term for additional working capital.

ABOUT CONSOLIDATED ZINC LIMITED

Consolidated Zinc Limited is an Australian junior exploration company listed on the Australian Stock Exchange (ASX: CZL). It owns 100% interests in the Pilbara Lithium and Wandagee Projects, which comprise approximately 1,400km2 in 5 granted exploration licences (plus 1 EL Application), located in the Pilbara and Gascoyne regions of Western Australia. The Pilbara Projects are highly prospective for lithium and situated near two of the world's largest hard rock lithium deposits/mines (ASX: PLS – Pilgangoora & ASX: MIN – Wodgina) and other deposits and occurrences near Marble Bar (ASX: GL1's Archer Project). Consolidated Zinc also owns the Plomosas Mine (Mexico) where, as described in this news release, Consolidated Zinc has signed a binding conditional sale agreement with IMPACT Silver for the sale of the Plomosas project for US$6 million (cash and shares) plus a 12% NPI royalty.

Jett Capital Advisors, LLC are acting as advisor to Consolidated Zinc Limited.

ABOUT IMPACT SILVER

IMPACT Silver Corp. (TSXV:IPT) is a successful producer-explorer with two mining projects in Mexico.

- Royal Mines of Zacualpan Silver-Gold District: IMPACT owns 100% of the 211 km2 Zacualpan project where three underground silver mines and one open pit mine feed the central 500 tpd Guadalupe processing plant. To the south, the Capire Project includes a 200 tpd processing pilot plant adjacent to an open pit silver mine with an NI 43-101 inferred mineral resource of over 4.5 million oz silver, 48 million lbs zinc and 21 million lbs lead (see IMPACT news release dated January 18, 2016 for details and QP statement, and Footnote 3 below for report reference). Company engineers are reviewing Capire for a potential restart of operations. Over the past 17 years, IMPACT has placed multiple zones into commercial production and produced over 11.5 million ounces of silver, generating revenues over $230 million, with no long-term debt.

- Plomosas Zinc-Lead-Silver District: IMPACT signed the sale agreement with Consolidated Zinc Limited (ASX: CZL) of Australia to purchase the 30 km2 Plomosas property and mining operations for US$6 million (cash and shares) plus a 12% net profits interest. Plomosas is a high grade zinc-lead-silver producer with exceptional exploration potential. Upon closing of the purchase / sale transaction, IMPACT plans to upgrade the mill and mine with the aim to recommence operations in the near term followed by plans for expanding operations. Exploration potential at Plomosas is exceptional with only 600m of the 6 kilometre long structure assessed plus other exploration targets including untested copper-gold targets. Regionally, Plomosas lies in the same mineral belt as some of the largest carbonate replacement deposits ("CRD") in the world.

Additional information about IMPACT and its operations can be found on the Company website at www.IMPACTSilver.com. Follow us on Twitter @IMPACT_Silver and LinkedIn at https://www.linkedin.com/company/impactsilver

Qualified Person and NI 43-101 Disclosure

George Gorzynski, P.Eng., is a "qualified person" within the meaning of NI 43-101 and has approved the technical information contained in this news release. Mr. Gorzynski is Vice-President, Exploration and a director of IMPACT.

On behalf of IMPACT Silver Corp.

"Frederick W. Davidson"

President & CEO

For more information, please contact:

Jerry Huang

CFO | Investor Relations

O: (604) 681 0172 or inquiries@impactsilver.com

C: (778) 887 6489 Direct

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Footnotes:

1. Plomosas mineral resources are reported by Consolidated Zinc Ltd. (CZL:ASX) on their website (https://www.consolidatedzinc.com.au) under the Australian JORC (2012) Code as mineral resources "depleted as at December 2021". IMPACT's Qualified Person has reviewed but not verified in detail these current reported mineral resources and is only reporting them as material recent mineral resources reported by CZL and available in the public record. IMPACT believes the estimates are relevant and reliable, given they are reported to Australian JORC standards; however, IMPACT's Qualified Person has not done sufficient work to classify them as current Canadian NI 43-101 mineral resources.

2. Reference: Alexandri, A. Gonzalez, H., & Salas, H. (2022). Plomosas Project (CZL), Field Visit Report. IMPACT Silver Corp. private report on field visits and compilation of historic and recent data, 56 pages.

3. Reference: Ristorcelli, S.J. & Gorzynski, G. (2016). Technical Report on Mineral Resources for the Capire Silver-Lead-Zinc Project, Pedro Ascencio Alquisiras Municipality, Guerrero, Mexico. Prepared for IMPACT Silver Corp. by Mine Development Associates, Reno, Nevada. 82 pages. Available on www.sedar.com.

Forward-Looking and Cautionary Statements

This IMPACT News Release may contain certain "forward-looking" statements and information relating to IMPACT that is based on the beliefs of IMPACT management, as well as assumptions made by and information currently available to IMPACT management. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Such statements include, but are not limited to, statements regarding completion of the Plomosas agreement and estimated timing thereof, the potential for defining and extending the known mineralization, and plans for drilling and future operations at the Company's projects or plans for financing.

Such forward-looking information involves known and unknown risks and assumptions, including with respect to, without limitation, exploration and development risks, expenditure and financing requirements, title matters, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, pandemics and one-time events. Should any one or more risks or uncertainties materialize or change, or should any underlying assumptions prove incorrect, actual results and forward-looking statements may vary materially from those described herein. IMPACT does not assume the obligation to update any forward-looking statement or beliefs, opinions, projections or other factors, except as required by law.

At Zacualpan, the Company's decision to place a mine into production, expand a mine, make other production related decisions or otherwise carry out mining and processing operations, is largely based on internal non-public Company data and reports based on exploration, development and mining work by the Company's geologists and engineers. The results of this work are evident in the discovery and building of multiple mines for the Company and in the track record of mineral production and financial returns of the Company since 2006. Under NI 43-101, the Company is required to disclose that it has not based its Zacualpan production decisions on NI 43-101 mineral resources or reserve estimates, preliminary economic assessments or feasibility studies, and historically such projects have increased uncertainty and risk of failure.

Figure 1: Location map of Plomosas Mine and nearby mines and infrastructure. References to nearby projects are for information purposes only and there are no assurances that Plomosas will achieve similar results.

Figure 2: Schematic cross section of Plomosas Mine mineralization (from CZL website)